How will the FCA consultation affect the cost of your inbound calls?

Callstream CEO, Mick Crosthwaite, was recently interviewed by the insurance press to provide advice to the industry about this issue. Read the articles published here: Insurance Times and Post Online

Is your company FCA regulated?

The FCA has recently recommended in its consultation paper ‘Improving Complaints Handling’ (Dec 2014) that FCA regulated companies should no longer be exempt from The Consumer Rights Directive that came into force in the summer 2014. We take a look at the cost implications and the options that will be available to the insurance industry if these changes are approved.

What is The Consumer Rights Directive?

The Directive requires that consumers should be able to contact a company for post-sale queries or complaints via a basic rate telephone number, instead of using higher priced 0844 and 0845 numbers. Insurance and financial services companies are currently exempt, but the FCA is now recommending that FCA-regulated companies should adhere to this EU directive.

How will this affect those within the insurance industry?

It is important that consumers are able to contact companies they have bought something from without significant extra cost. Due to of the nature of the insurance services, insurers and brokers are likely to have many post-sale calls. These may include policy queries, updates to policies and personal details, along with claims calls. Many insurers and brokers currently use 0844 and 0845 numbers for customers to call. These numbers generate a small amount of revenue for companies using them, which will be lost if the FCA adopt The Consumer Rights Directive when the consultation closes in March 2015. There will also be an additional cost to adopt less expensive numbers for post sale calls.

How much could this cost your business?

Working on the basis of 125,000 minutes of inbound calls per month (a typical volume for an insurer with a 75 seat call centre) we have calculated that the lost revenue, plus the added cost of moving to a Freephone 0800 number, could be much as £90,000 a year.

What options does your business have?

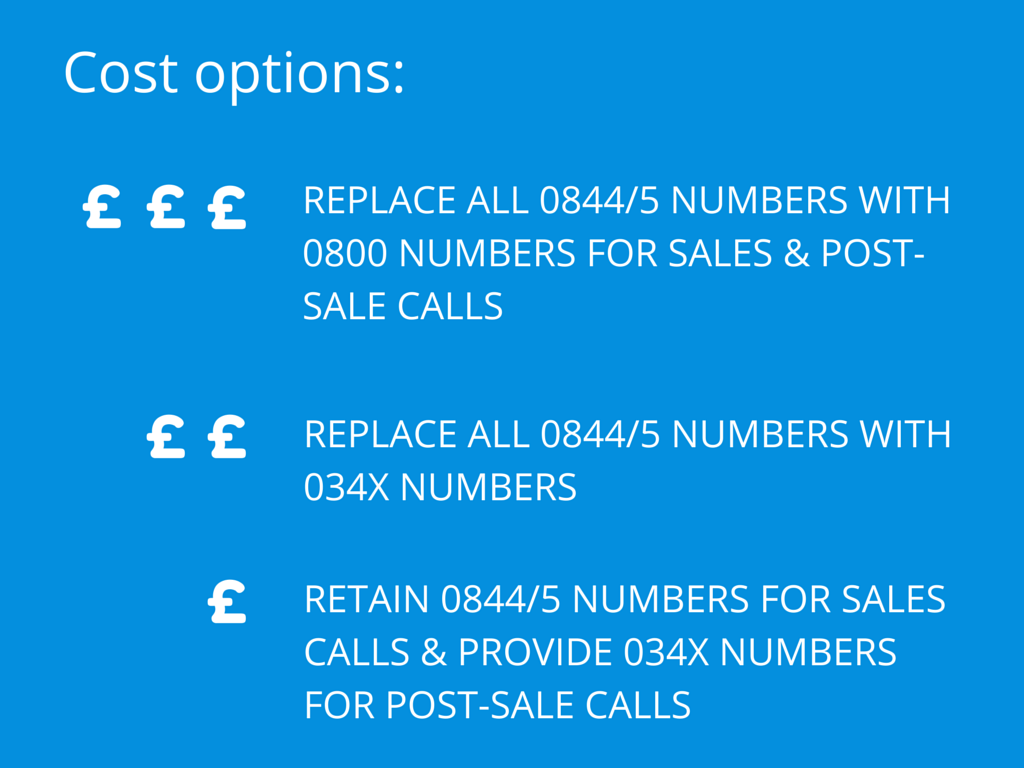

Option 1: (£££)

Replace all 0844/5 numbers with 0800 numbers

In our experience, 0800 numbers do increase call volumes as customers appreciate the ability to contact their broker / insurer without charge. However, the cost implications from the lost revenue of the 0844 calls and new cost of the 0800 calls needs to be evaluated.

From June 2015 onwards, the cost of a company receiving calls on 0800 numbers is set to increase. Currently, 0800 numbers are free to call from landlines and not mobiles. In June Ofcom will require all calls made to 0800 numbers to be free of charge which will result in an increase in cost of receiving calls on any 0800 number you advertise.

Option 2: (££)

For insurers and brokers where the cost of a complete shift from 0844/5 to 0800 isn’t affordable and they want to only advertise a single non-geographic number, they have the option of switching to an 034x number.

034x numbers are non-geographic standard rate numbers that charge consumers in the same way as 01 and 02 numbers and importantly, they also qualify as part of mobile phone users’ free minutes.

The financial impact would be 50% less than replacing 0844 numbers with 0800 freephone numbers.

Option 3: (£)

Publish different numbers for sales calls and post sale calls. Keep original 0844/5 number for sales calls and have a new 034x number alongside it for post sale & customer service calls. A recorded announcement can be played at the start of 0844/5 calls to inform existing customers that there is an option to dial a cheaper 034x number. This is the lowest cost approach to meet the directive’s standards, without sacrificing all of the revenue from 0844/5 numbers.

Talk to us today about the best option for your business and start preparing for the changes likely to happen following the end of the FCA consultation in March.